Deutsche Bank does not see any risks to its business in Russia as a result of the conflict in Ukraine. The DAX Group said late Wednesday that the commitment was “very limited and largely secured”. The bank has significantly reduced its presence and exposure in Russia since 2014 and reduced it again in the past two weeks. “Our direct risk positions are currently very limited and tightly managed,” said Stuart Lewis, Chief Risk Officer.

Specifically, net credit exposure to Russia is 0.6 billion euros after taking into account guarantees and guarantees. The lion’s share is accounted for by large Russian companies that have significant trade and cash flows outside Russia. The total loan commitment is 1.4 billion euros, which is about 0.3 percent of the total loan portfolio. Thus the net exposure to Ukraine amounted to 42 million euros (total 0.6 billion euros).

Rating agencies Fitch, Moody’s and S&P recently lowered Russia’s creditworthiness significantly and warned of default. The German Institute for Economic Research (DIW) considers that a state bankruptcy in Russia is very likely in the coming months due to Western sanctions. German investors were also said will be among them to suffer.

Deutsche Bank emphasized that the operational risks from a possible closure of its technology center in Russia are also very limited. This is just one of many bank technology centers around the world.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

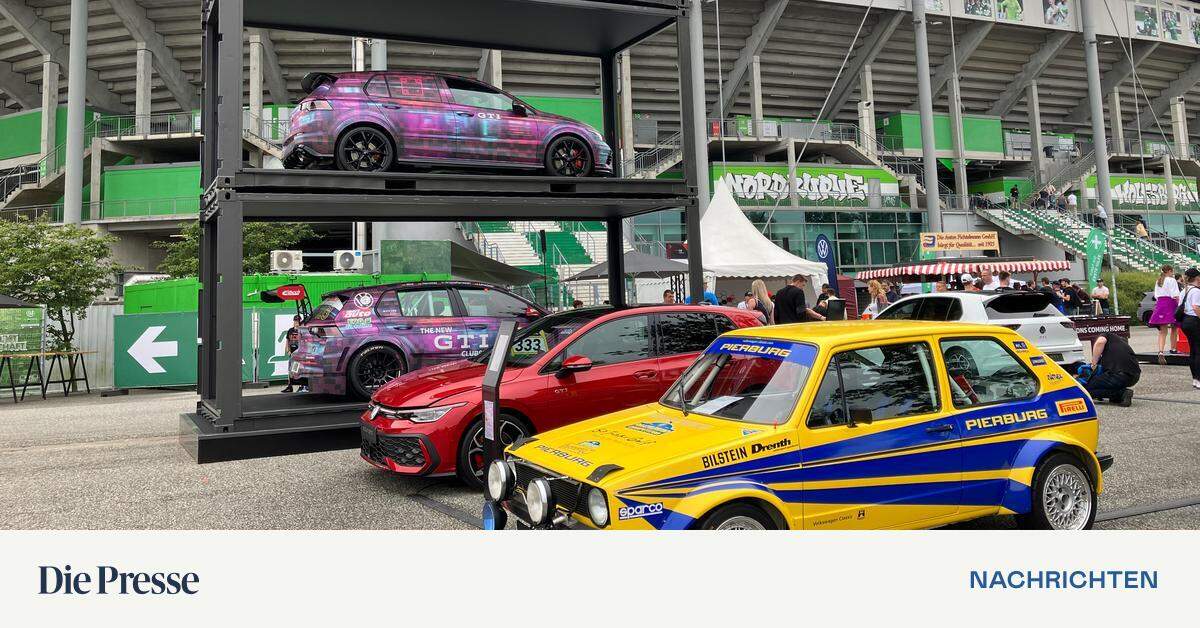

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.