Berlin (dpa-AFX) – As a result of the accounting scandal in the former Wirecard group Dax (DAX 30), complex company structures need to be controlled closely in the future. This is why the Bundestag granted the Federal Financial Supervisory Authority (BAFIN) additional powers on Thursday evening. The amendment also tightened requirements for auditors.

The fix package aims to prevent another scandal like the one that happened with the now insolvent financial service provider Wirecard. The group is said to have reported air bookings and fictitious profits in the billions for years. Financial regulators and auditors have come under heavy criticism for not being noticed earlier. The financial politician of the Social Democratic Party, Kansel Kiziltepe, declared that “such a case of fraud should never happen again in our country.”

When it comes to balance sheet review, responsibilities are grouped into Bafin. The previous two-stage procedure with BaFin and DRB should not be present – the DRB will be resolved. Additionally, auditors must now change after five years at the most so that they are no longer operationally blind.

In addition, auditors have a greater responsibility: the maximum liability limits for auditing firms geared to capital markets have been increased quadruple to 16 million euros. In the case of gross neglect, there is no longer an upper limit whatsoever. “False oath in the balance sheet”, that is, when it is wrongly claimed that the financial statement gives an accurate picture of the state of the company, in the future he can be punished with imprisonment of up to five years. / ax / tam / dp / fba

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

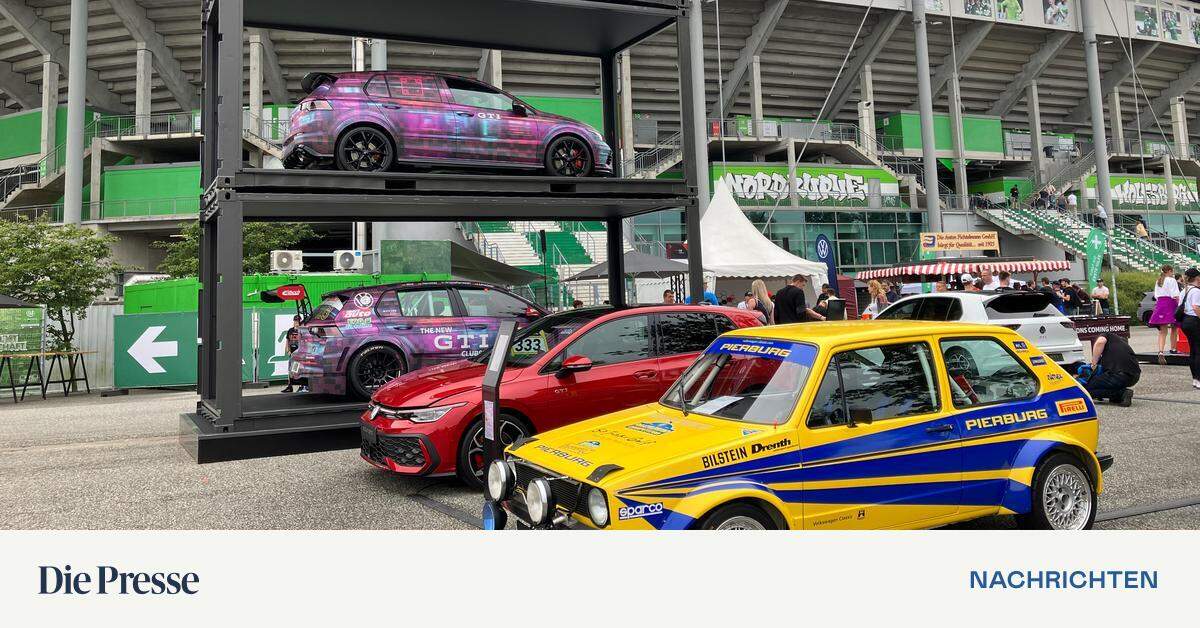

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.