In recent years, the coronavirus pandemic, and most recently the energy crisis, have sparked a broader debate about high executive salaries, particularly in the face of stark income inequality.

This has led asset managers to engage in more executive pay discussions with the companies in which they invest. Board compensation policies that align well with a company’s strategy, including relevant sustainability goals, are often closely linked to a company’s success. Accordingly, executive compensation should stimulate long-term value creation and contribute to sustainable practices.

Long-term incentive structure fully linked to performance

NN Investment Partners (NN IP) believes that compensation plans should be 100% performance-based. All performance criteria must be measurable, transparent and relevant to the company’s long-term success. Therefore, NN IP expects companies to also include non-financial sustainability measures in their reward policies. If senior management is not rewarded for implementing a sustainable business strategy by linking sustainability measures to compensation, NN IP may vote against the company’s compensation policy.

cooperation

NN IP typically works with organizations over three to five years and sets goals and change milestones to track progress. You support and advise companies you invest in and monitor their business. If progress is insufficient or if the Company consistently ignores NN IP’s comments, additional actions may be taken, including exclusion of the Company from the investment portfolio. However, this is a last resort: NN IP prefers to remain invested and have a say to guide change.

Coordinated engagement creates change

Florentin van den Ehrenbemet, Responsible Investment Specialist at NN Investment Partners comments: “In the world’s largest emitter of greenhouse gases, NN IP can vote against the compensation plan if the company does not include climate performance elements in the executive compensation system. We also use compensation votes. As a form of escalation – for example, when we are concerned about lack of progress on specific sustainability goals. In general, we support shareholder proposals that address material sustainability issues. Even if some proposals are not accepted, we believe our vote sends a strong message to Board of Directors. But to really achieve anything, more companies and investors need to be involved.” (kilobytes)

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

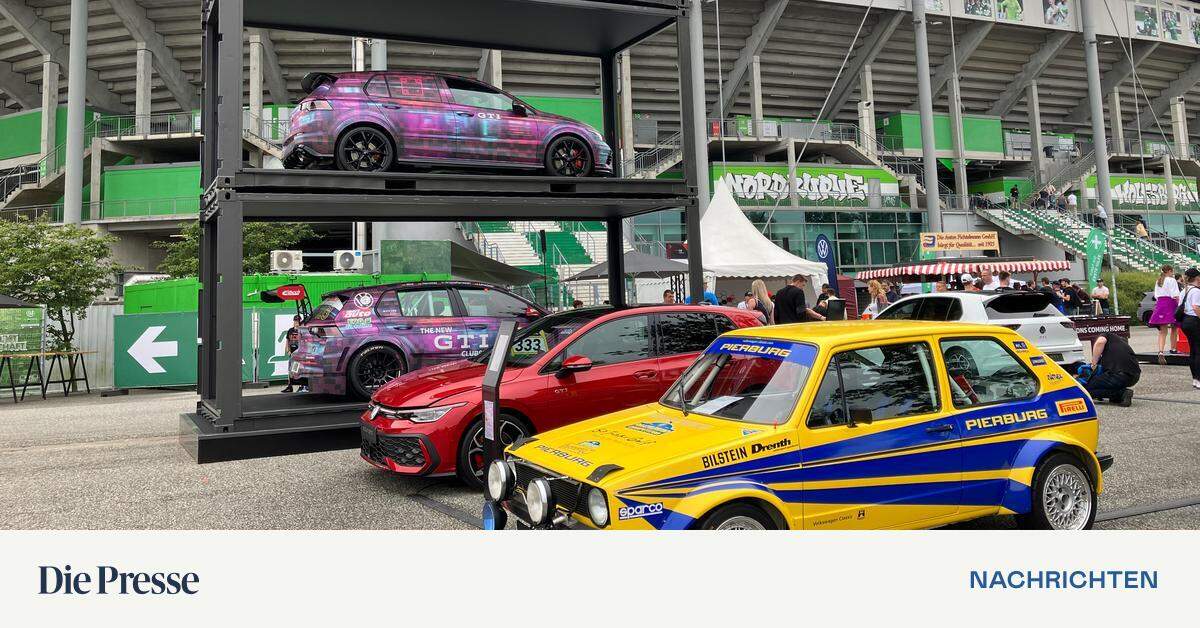

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.