BKS Bank presented its balance sheet on Thursday. “We had a very good financial year despite the difficult economic environment,” says Herta Stockbauer, CEO of BKS. Annual profits after tax amounted to €179.1 million, an increase of €115.5 million compared to 2022. The total balance sheet amounted to €10.7 billion (plus 1.3 percent).

Overall, it was a year full of “lights and shadows” as the economy had a dampening effect, but interest rate developments had a positive effect. Disappointingly, inflation in Austria remained at 4.2% in March, while Germany is already much closer to the ECB's interest rate target of 2.2%. “We are miles away from boom phase,” Stockbauer says. However, there are positive signs in eastern markets such as Slovenia.

More business loans

“We recorded a very good increase of over three percent in financing business,” Nicholas explains. Juhász, Member of the Board of Directors and Chairman-designate of the Board of Directors of BKS Bank. The volume of loans increased by 1.5 billion euros to 7.5 billion. These increases were mainly due to corporate loans, as there was a decline in the private client segment due to inflation, increased construction costs and stricter lending guidelines (KIM regulation). In previous years, corporate loans typically made up 85 percent and private client loans 15 percent of the financing business, but in 2023 there has been a shift. The share of corporate loans rose to 90 percent of the volume. Due to interest rate developments, the demand for savings products with longer commitment periods has increased. BKS Bank recorded a 62.7 percent increase in term deposits and a 73 percent increase in the private client segment.

Stockbauer stresses that digitalization and sustainability are currently “mega trends” for banks. BKS Bank already offers a number of digital services to private clients, such as account opening and housing financing. You can also order money digitally such as currency for a trip home and order securities via the customer app. BKS Bank is also unifying its IT platforms across national borders. IT coordination in Slovenia will soon be completed.

Sustainable products in the lending and investment business are recording growth rates. The volume of these “green” products increased by 23.4% to 1.4 billion euros, equivalent to 13% of total assets. By 2025, BKS Bank, which also won several sustainability awards in 2023, wants to increase its share to 15 percent.

Change leadership

By the way, this was Stockpower's last annual press conference. As reported, she will step down from her term on the board on June 30 after more than 30 years at BKS Bank, including 20 years on the board. Her successor will be Juhasz, who has been with the company for 25 years. This ensures continuity, stresses the outgoing CEO. She hadn't thought of any new tasks yet, as there was still a lot to do before she left. But what is certain is that it will retain supervisory board functions like those at Oberbank. She also wants to stay in touch with the Kleine Zeitung “Kärntner in Not” campaign, which is supported by BKS Bank.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

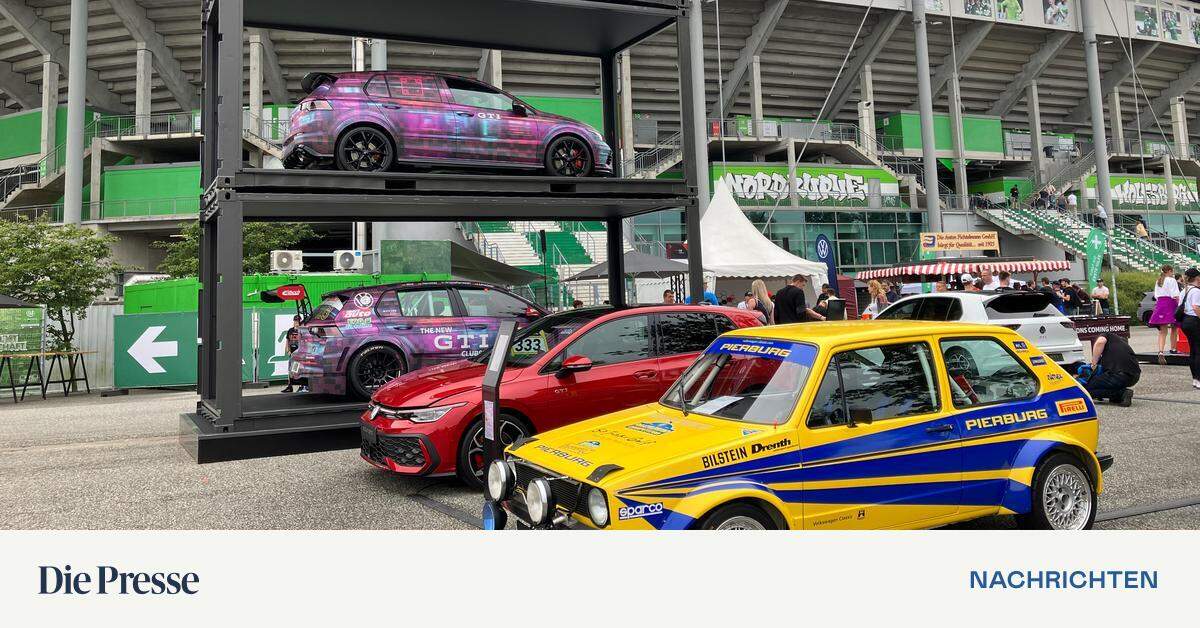

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.