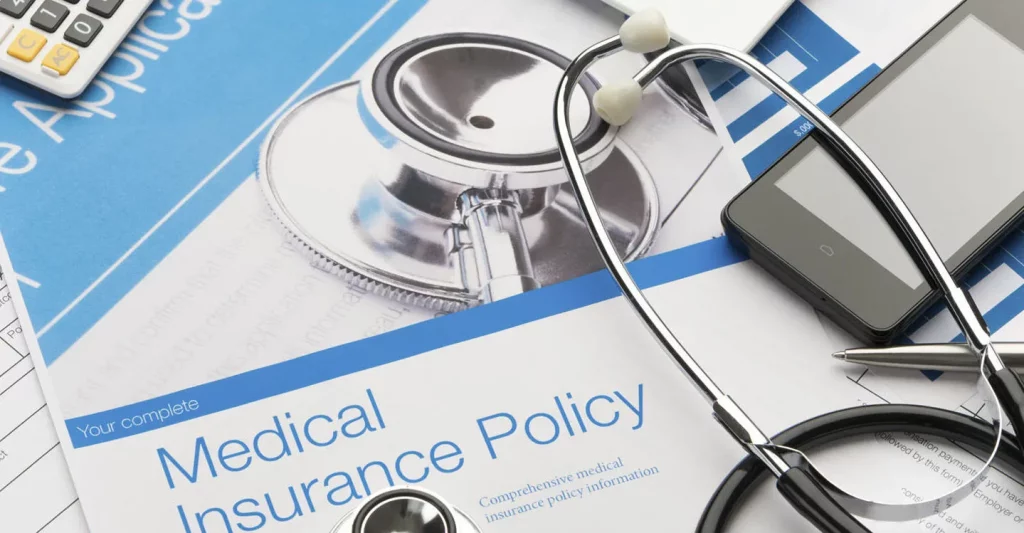

You might not consider buying family health insurance mandatory, but the consequences it leads to could be devastating. Pandemic has been an excellent example of how it pushed people to shell out their savings at once for the treatment of themselves or their dependents. It has led patients and their families to the brink of heavy debts due to skyrocketing cost of medical treatment. Therefore, medical insurance for family is one of the most indispensable investments in such bleak times.

This article will help you understand the pitfalls of not buying medical insurance for your family and encourage you to buy one as soon as possible.

Why People Don’t Buy Medical Insurance for Family

In spite of being a safety cushion, people doubt investing in health insurance policies due to a lack of awareness of its benefits. Below are some of the reasons why people avoid buying a medical insurance policy:

Doubt the Affordability- You must be regular with the premium, so your health insurance doesn’t lapse. You always have the option to pay your monthly or yearly premium. Many believe that they cannot afford to pay the premium regularly and get nothing in return. But, this is a counterproductive investment as health insurance definitely comes to your rescue as and when you need it the most.

Lack of Awareness- If you are unaware of something highly beneficial to you in the long run, you are bound to face loss. People consider health insurance for family futile as they don’t see its benefits clearly. Being fully aware of the emerging market for family health insurance will definitely help you reap its advantages in times of crisis.

Complicated Documentation- Documentation used to be one of the tedious tasks due to its traditional methods. However, these days many companies have come up with an easy documentation process and making it all online.

Unimportant Investment- Half-hearted approach to investing in health insurance is not wise for it can lead to significant financial losses. Many think that this is not the investment that can benefit them monetarily. Little do they know that in times of medical emergency, medical insurance comes to their rescue and doesn’t let them exhaust their savings.

Have Faith in their Health- Believing that you are healthy is good but taking your health for granted is unwise. Those who are young and healthy believe that they don’t need to invest in a health insurance plan. However, whether young or old, it is essential to secure yourself with health care that can help you during emergencies.

Consequences of Not Buying Medical Insurance for Family

Exorbitant Healthcare Expenses- You may have to spend heavily out of your pocket if you are not equipped with a comprehensive health insurance plan. Medical costs have increased steeply over the years, and spending everything you have saved on treatment becomes burdensome.

Loss of Savings- Exhausting all your savings in an unforeseen emergency can be highly disappointing. If you don’t have health insurance in place, you are bound to spend everything you have saved for a long time. Buying medical insurance for family can save you from this distress whenever you are in need.

Getting into debts– Debts may take every penny you have earned and give you anxiety. When you have to borrow money on loan for the treatment, you will eventually fall into debt. However, health insurance can safeguard you against medical contingencies and borrowing money for the treatment.

Increases stress and anxiety- Being unable to have a financial backup during unforeseen circumstances leads to immense stress and anxiety. Health insurance ensures that you are financially backed up when there is a medical emergency, which would also help you be at ease mentally.

Lack of Quality Health Care- Not taking quality healthcare due to short of funds may lead to severe issues with the patient. With comprehensive health insurance for the family, you can be assured of receiving quality treatment along with coverage benefits.

Missing out on Tax Benefits- With health insurance, you also get tax benefits under section 80D. You will miss out on the tax benefits if you don’t get Medical Insurance for family.

The Bottom Line

Health insurance is definitely an expense, but with all its benefits, it is an advisable and wise investment that would shield your financial resources as well as a healthy feature. This safety net will ensure you don’t end up shelling out your savings at once.

Due to climate change, and sedentary lifestyles, we are more vulnerable to diseases and accidents than ever before. And such unpredictable circumstances can drain your savings in a moment. Therefore, getting medical insurance for family is a necessity, not a luxury. Care Health Insurance offers the most promising family floater plans that ensure you don’t suffer when in need. Be wise and secure your family today!

“Social media evangelist. Baconaholic. Devoted reader. Twitter scholar. Avid coffee trailblazer.”

More Stories

In “Cash for Rares” he reveals his plans

The DFB women face a tough fight against heavy favorites USA

Who is showing/broadcasting France vs USA (Olympia) live today on live stream and TV?