In July, the European Central Bank raised its key interest rate by 0.5 percentage points, followed in September by a historic increase of 0.75 percentage points.

This trajectory is now also reflected in higher interest rates on housing loans. According to figures from the National Bank, the interest rate on new loans in Austria was “2.08% by August, the highest rate since February 2017”. According to OeNB, this means “an increase of 96 basis points” compared to less than 1.12 percent (March 2021).

Fewer new loans since August

The development was driven in particular by “strong increases in interest rates for long-term interest-linked financing”. But at the same time, interest rates for the entire existing housing loan portfolio will rise “significantly for the first time” in July and August, particularly due to the rate adjustments for variable-rate loans.

With the long-term terms (ie at least 10 years) for the new loans, interest rates rose by 125 basis points to 2.55 percent from the previous year. In a region with variable interest rates (or with a short-term fixed rate of up to one year), interest rates have risen by 51 basis points, currently at 1.44 percent.

While demand for housing loans – despite rising interest rates – remained high until July 2022, a significant decline in new lending has now been observed for the first time. In August 2022, new loans granted within Austria to create and maintain living space amounted to €1.267 billion, the lowest since the beginning of 2017. The sharp drop in August is closely linked to higher interest rates, with rising property prices and persistently high inflation constraining the ability to bear the costs of real estate. Last but not least, since August 1st in Austria Stricter purchasing rules.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

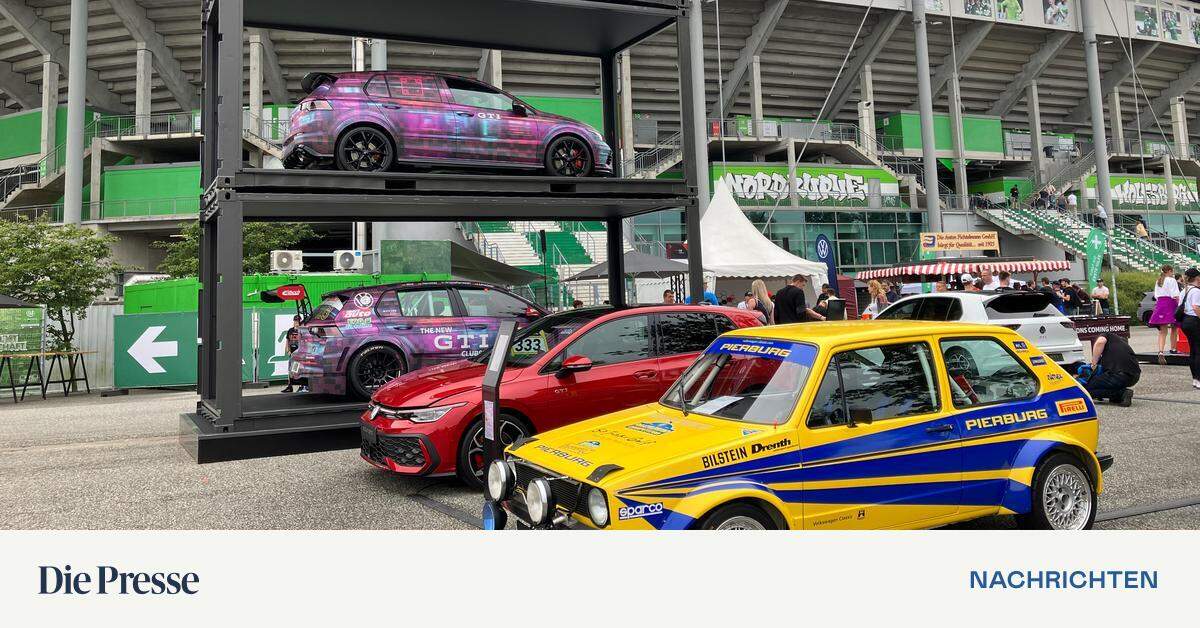

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.