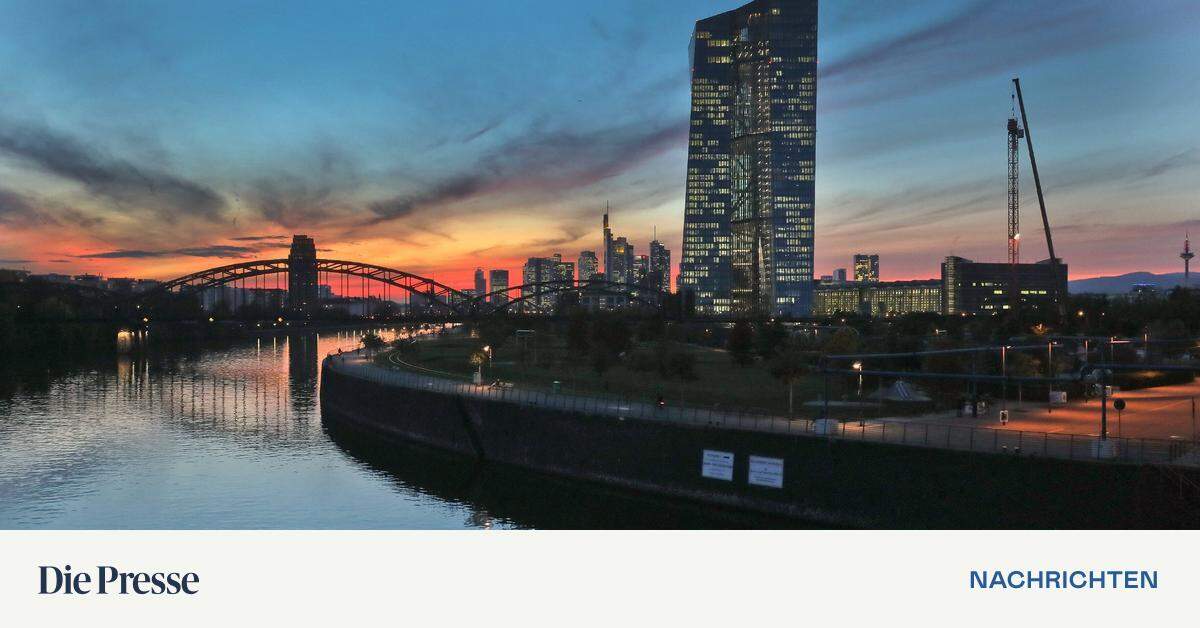

According to a media report, the European Central Bank is first examining banks for just one borrower: René Benko’s Signa Group. What is more behind it.

It is an absolute exception in the world of bank examinations. A team of bank supervisors—mostly Austrians—check European banks for just one select borrower: the Signa holding company of Tyrolean real estate tycoon René Benco. “This has never happened before,” the German daily “Frankfurter Allgemeine” quoted a longtime bank board member who wished to remain anonymous.

Accordingly, all banks that have business relations with Signa are included in the OSI: state banks, private real estate banks, German and of course Austrian financial institutions. Bank supervisors should know how much Benko loans to each enterprise for a long time, even if the Signa empire is branched: under the parent company Signa (holding company), two-thirds of which belong to the Benko family enterprise, there are three separate companies, in one of which there is also the Galeria department store chain Karstadt Kaufhof.

The investigation team collects data on whether Signa Group lenders have complied with lending standards. They also question the collateral of the loan and check whether all interest payments have been made and whether the financial covenants agreed upon in the loan agreement have been complied with or may have been broken. These examinations usually last from six to eight weeks.

The European Central Bank has been examining real estate exposure for some time

It has been known for some time that the ECB takes a hard look at banks’ real estate risks. All types of mortgages and corporate loans are examined. To date, bad loan (non-performing loan) rates have been very low. The ECB itself has not confirmed the report. Signa declined to comment when asked. The holding company probably can’t either, because companies are never informed of any bank audits by the ECB. What is certain is that these on-site inspections are done regularly. In technical terms they are called “Oasis”.

Signa’s previous financing partners have included insurance companies Allianz, R+V, Gothaer, Bayerische Versorgungskammer, Signal Iduna and Continentale, as well as banks such as LBBW, Bayern LB, Helaba, Aareal and Deutsche Pfandbriefbank; from Austria, including Raiffeisen, Bawag, Uniqa, and Erste Bank der Sparkassen. In addition to international houses such as BNP Paribas and Citigroup. To what extent these funded partners are still up to date is not known.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

TU Graz puts car batteries to the test

More than 100 energy venues open their doors on the “Long Energy Day” – Styria

Host Hotels & Resorts beat first-quarter estimates thanks to higher demand for business travel