In the first quarter of 2021, 34, and thus about half of all known FMA investment fraud cases, were related to investments in crypto assets. The average amount of damage in these cases was around € 17,000. Public inquiries to the FMA Consumer Information Center on the topic of crypto assets have risen sharply in recent years and are now at an consistently high level.

Crypto assets can be divided into three classes:

- Payment code: These codes are intended as a payment function. If your contractual partner accepts this as a method of payment, you can use it to purchase goods or services. The best known actor of this genre is Bitcoin.

- safety Code: The security icons simulate “classic securities” and can be styled like bonds or stocks. This gives you the right to recurring payments, for example, or you can exercise voting rights.

- Utility code: Utility codes are mainly used to provide the owner with a benefit in relation to a specific product or service. It’s a lot like an access key.

Just the property as a token or a coin in the blockchain does not produce any value. Determining whether a cryptocurrency asset and its value depends on the rights and claims that you receive through the acquisition of the cryptocurrency asset, or on whether the cryptocurrency asset is already listed on a trading platform. Tokens / coins can be purchased on cryptocurrency exchanges from the markets directly from the issuer or from third-party providers such as Bitcoin devices.

Initial Coin Offering (ICO)

Often the initial release of crypto assets takes place via so-called ICO. This is mostly a type of corporate or project financing. Companies raise capital for a project and in return issue crypto assets associated with the company or project in question.

For ICO, there are currently no legal requirements in the form of corporate information and transparency obligations.

Exception security code: The issuer may be required to publish a prospectus. ICOs often take place very early on when the underlying business model is still immature. At the time of release, there is only a promise of future benefits and the associated increase in value. It is not certain that this promise can be fulfilled in the future!

Attention: There is an increasing number of fraud cases related to ICO. Studies have shown that more than 80 percent of observed ICOs are fraudulent.

More information is available at FMA website!

Photo: © Monster Ztudio – stock.adobe.com

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

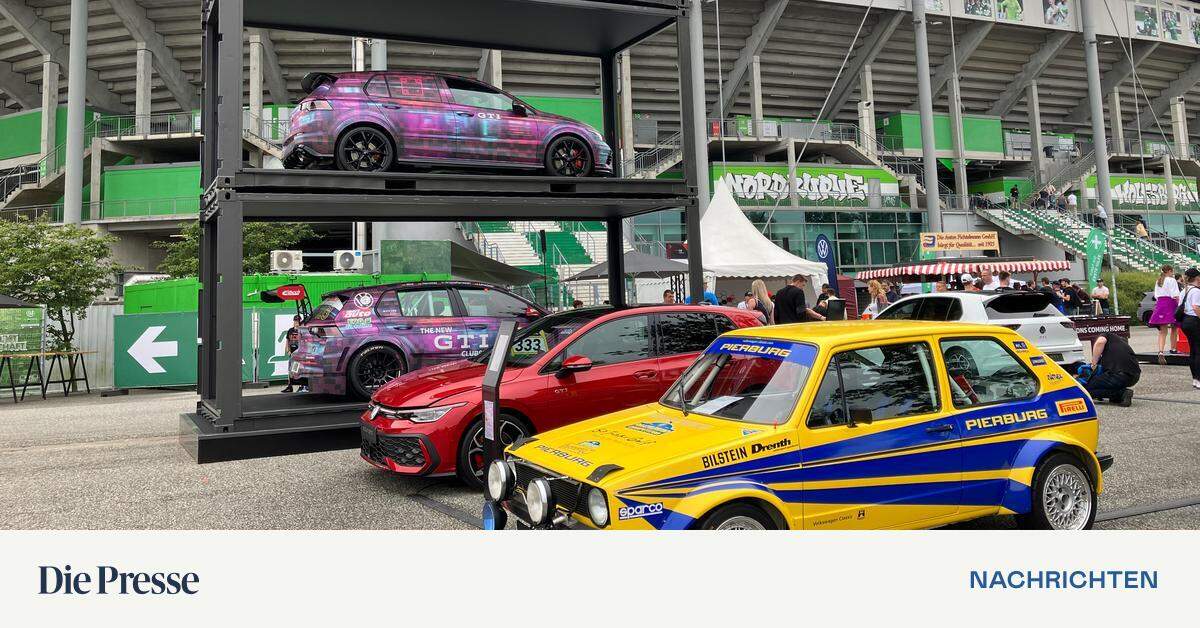

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.