The first increase in key interest rates in July is considered constant. The question now is how high interest rates will rise.

Vienna. The European Central Bank According to experts, next week the European Central Bank will prepare the first rate hike in eleven years. As an important precondition for this, the end of the APP multibillion-dollar bond purchase program should be closed at the European Central Bank’s external meeting in Amsterdam on Thursday. This is seen as a prelude to the rate hike that is likely to follow in July.

European Central Bank President Christine Lagarde He has indicated that negative rates will be historical by the end of September. “The first rate hike in July is now almost a foregone conclusion, with the real question being how big the rate hike will be,” said Matthew Ryan, analyst at financial services firm Iberi.

The French at the helm of the European Central Bank want to see bond buying stop at the start of the third quarter: “Whether it’s on June 30 or a few days later, it’s irrelevant in the end. The only relevant thing is that it’s over and the path is clear for a rate hike in July meeting CommerzbankExpert Michael Schubert. The APP, which was used to provide financial markets with liquidity even after the end of the large PEPP emergency program, has already been significantly reduced – to a monthly purchase volume of only 20 billion euros.

Some currency watchers at the ECB Council are already shifting their hooves in light of the first rate hike: “We will take this step in July. The time for waiting and indecision is over,” says Slovak Central Bank President Peter Casimir. to a record 8.1 per cent At the June meeting, a clear indication should be given of where the flight is heading, i.e. demands Federal Bank-president Joachim Nagel. The first rate hike in July should be followed by others in the second half of the year.

On the other side of the Atlantic Ocean, there is US Federal Reserve The shift in interest rates actually happened in March. In early May, the Federal Reserve made its largest rate hike in 22 years, raising rates by half a point to a new range of 0.75 to 1.0 percent. Increases of the same size were indicated in the next few sessions.

Expectations are in focus

“The ECB realizes that in view of the currently very high inflation rates, it has to initiate a change in interest rates,” explains Schubert, an expert at Commerzbank. Otherwise, you lose control of inflation expectations. Many economists assume a whole series of steps. “We expect the European Central Bank to end net asset purchases in June and raise interest rates by 25 basis points in July, September and December as well as in March 2023,” Citigroup experts wrote.

New economists’ forecasts from the European Central Bank available for Thursday’s interest rate meeting may provide more arguments for a shift in interest rates. According to Ulrik Kastens, European economist at fund firm DWS, this should point to weak growth and a significant increase in inflation. In their March forecast, ECB economists saw inflation of 5.1% this year, and 2.1% projected for 2023. In the view of Frederic Ducrozet, chief economist at Swiss asset manager Pictet, the inflation forecast for 2024 is A special focus. (APA/Reuters)

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

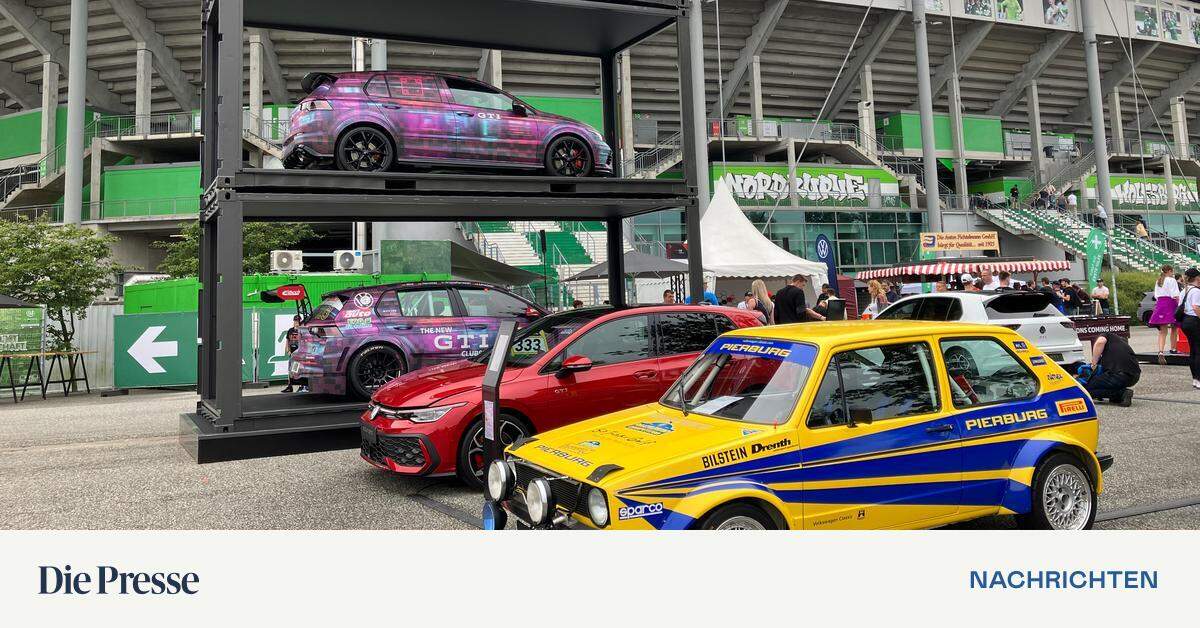

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.