Comment

America and China have never been close friends. Now they become rivals and face each other. Who is to blame depends on perspective. After China joined the WTO, it was hoped that foreign companies would become increasingly open, liberalized and treated fairly. Hopes unfulfilled. Instead, Chinese companies adopted Western technology and became competitors.

Coupled with low wages, China has become the workplace of the world. At first it applied to the masses, and then it was increasingly used for technical products. The US considered this a one-sided relationship. As China has made no secret over the years of its desire to position itself in the world at least alongside the United States, technology transfer is becoming increasingly difficult. China does not want to roll out the red carpet in its efforts.

From China’s perspective, things look different. It broke the process of Western companies often looking to profit from countries without contributing anything to the country’s development. China overcame this unilateralism. While Western corporations make billions in profits, people want to benefit at least economically, technologically and socially.

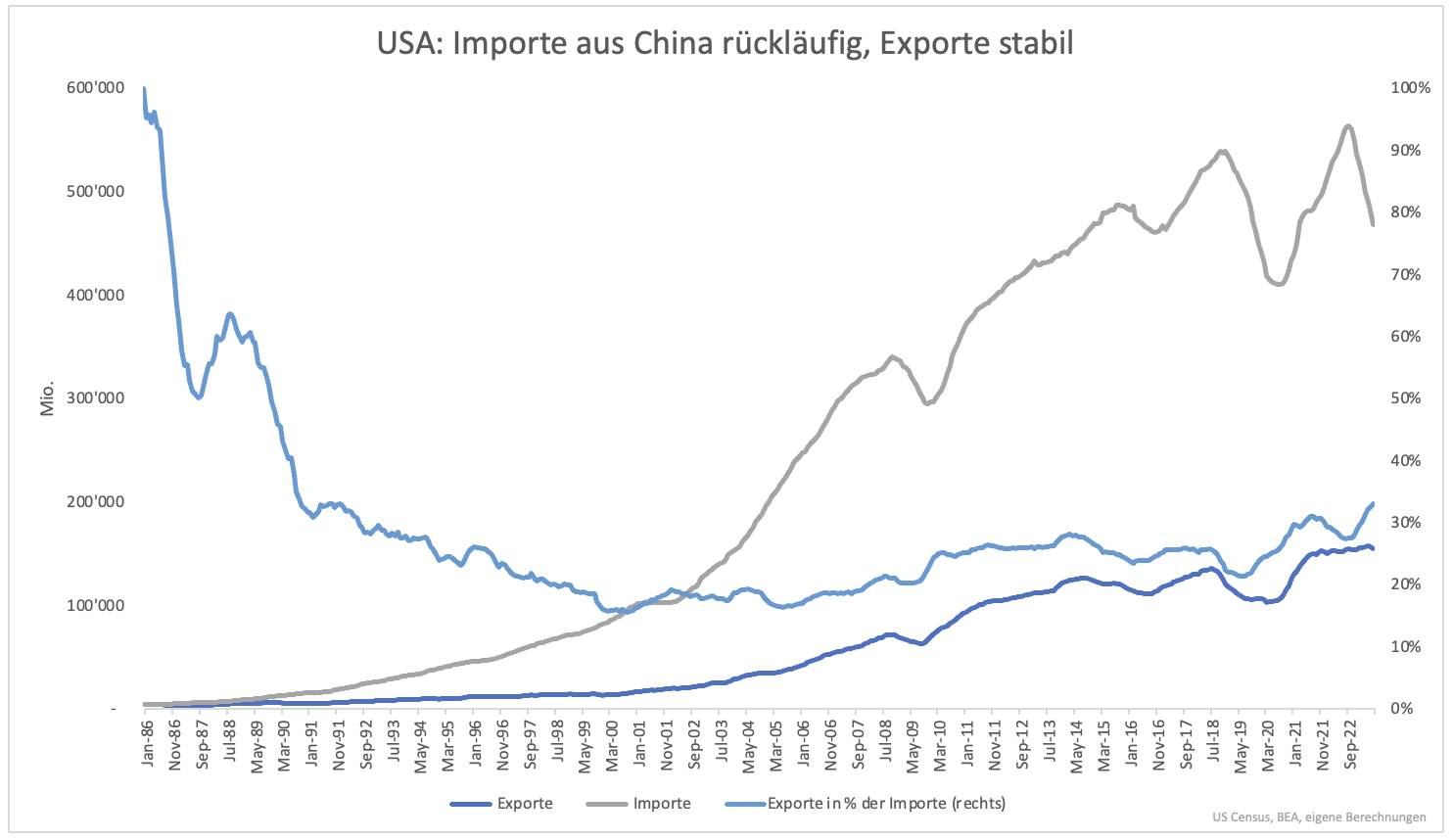

Both views are understandable. The result was something that both the US and China did not expect. The US began to disengage from China years ago. Imports from China are not higher today than they were in 2015. U.S. exports to China are at their highest level since the early 1990s as imports have declined (Chart 1).

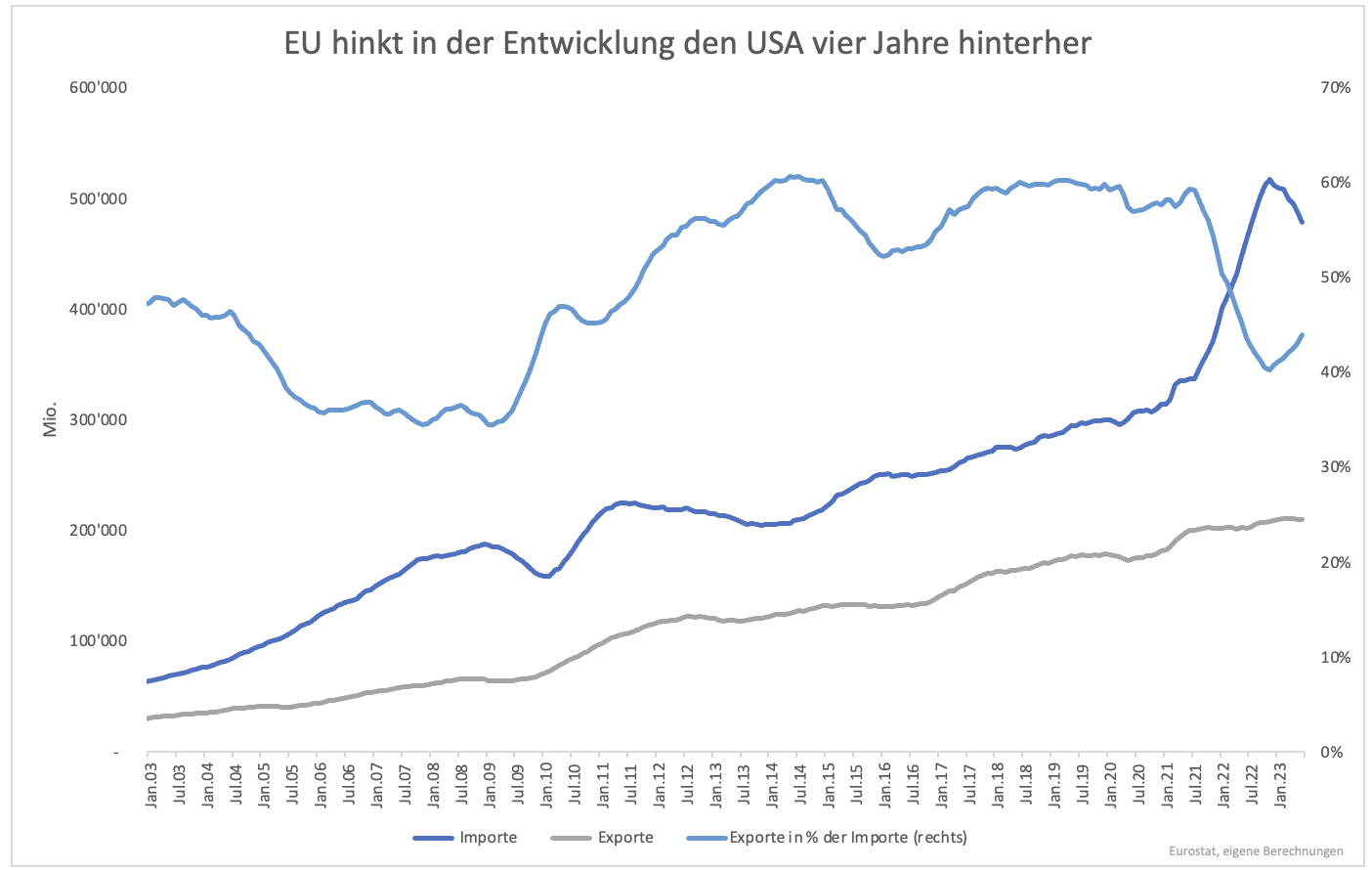

There is a disconnect in trade. The EU is not yet ready here. Imports are only down to 2022 levels. The share of exports remains low as it was in 2009 (Figure 2). While the US is moving towards a better balance, the EU’s trade imbalance with China has increased. China accounts for 16% of all EU imports. In the US it is 12%.

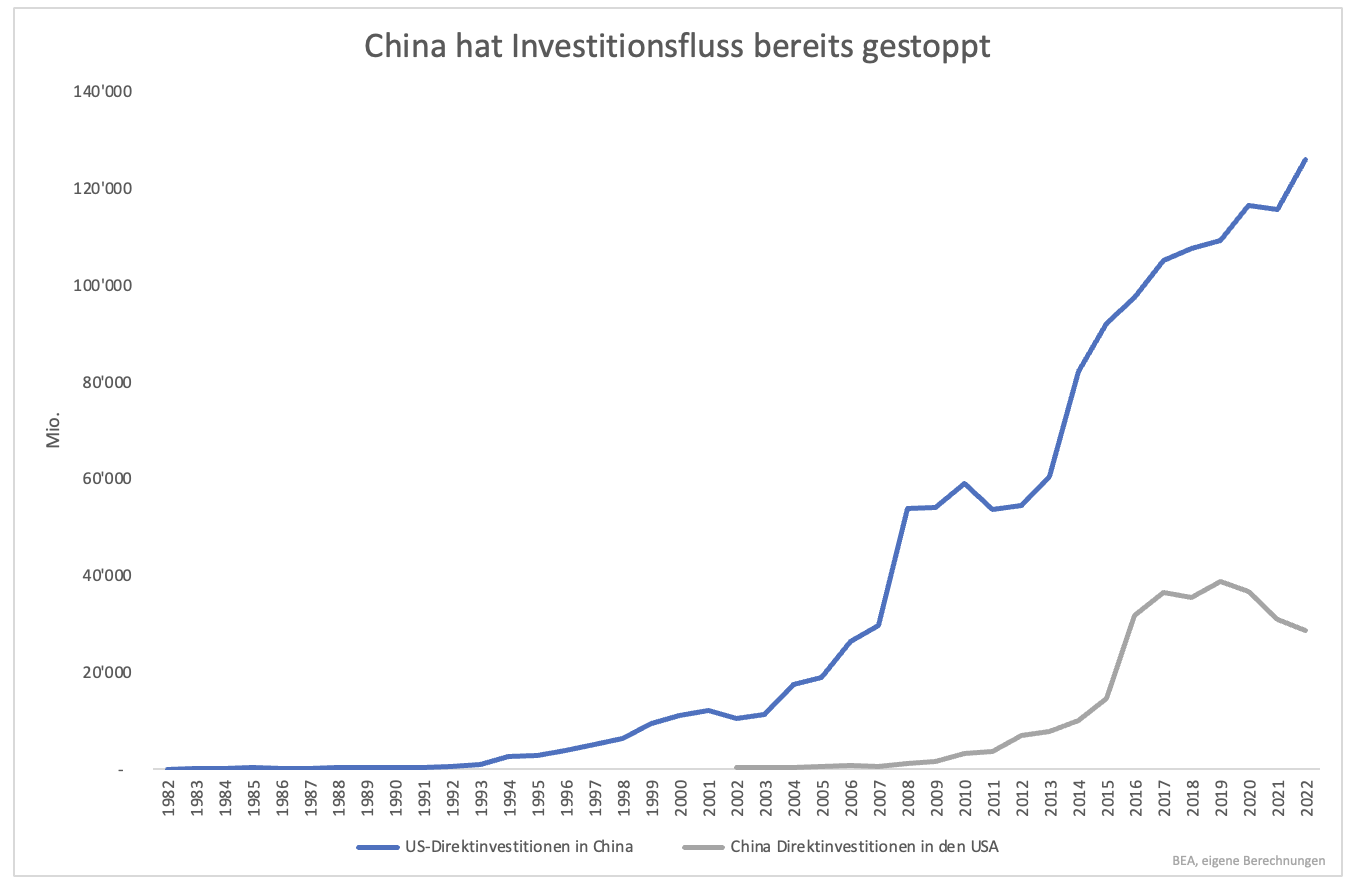

Trading is one thing, investment is another. American companies are still investing in China, but less so. China is now sometimes described as uninvestable. Investments are likely to fall sharply in the future. China began investing less in the US several years ago. Investment amount also decreases. Fixed assets are sold in the United States (Chart 3).

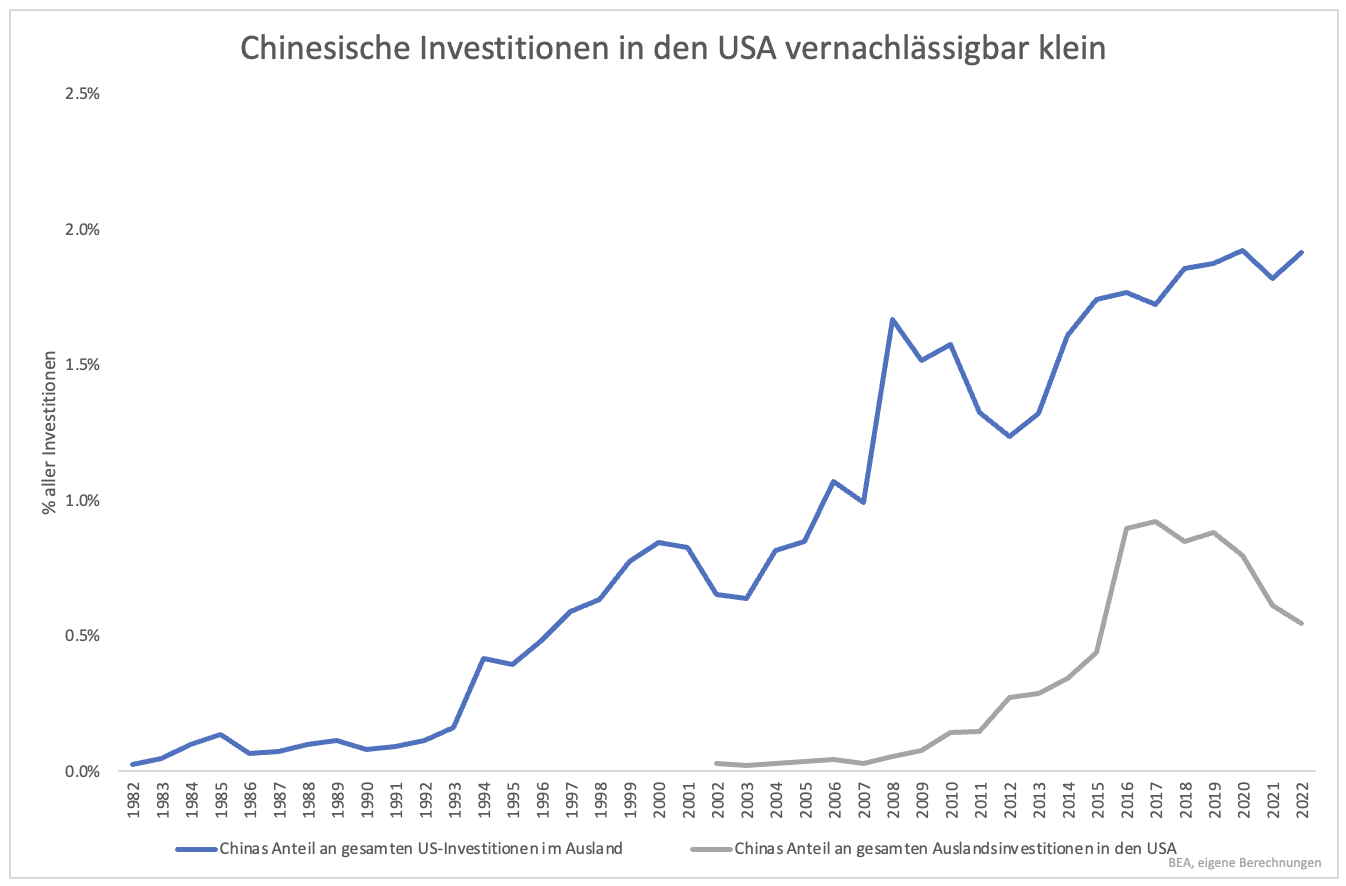

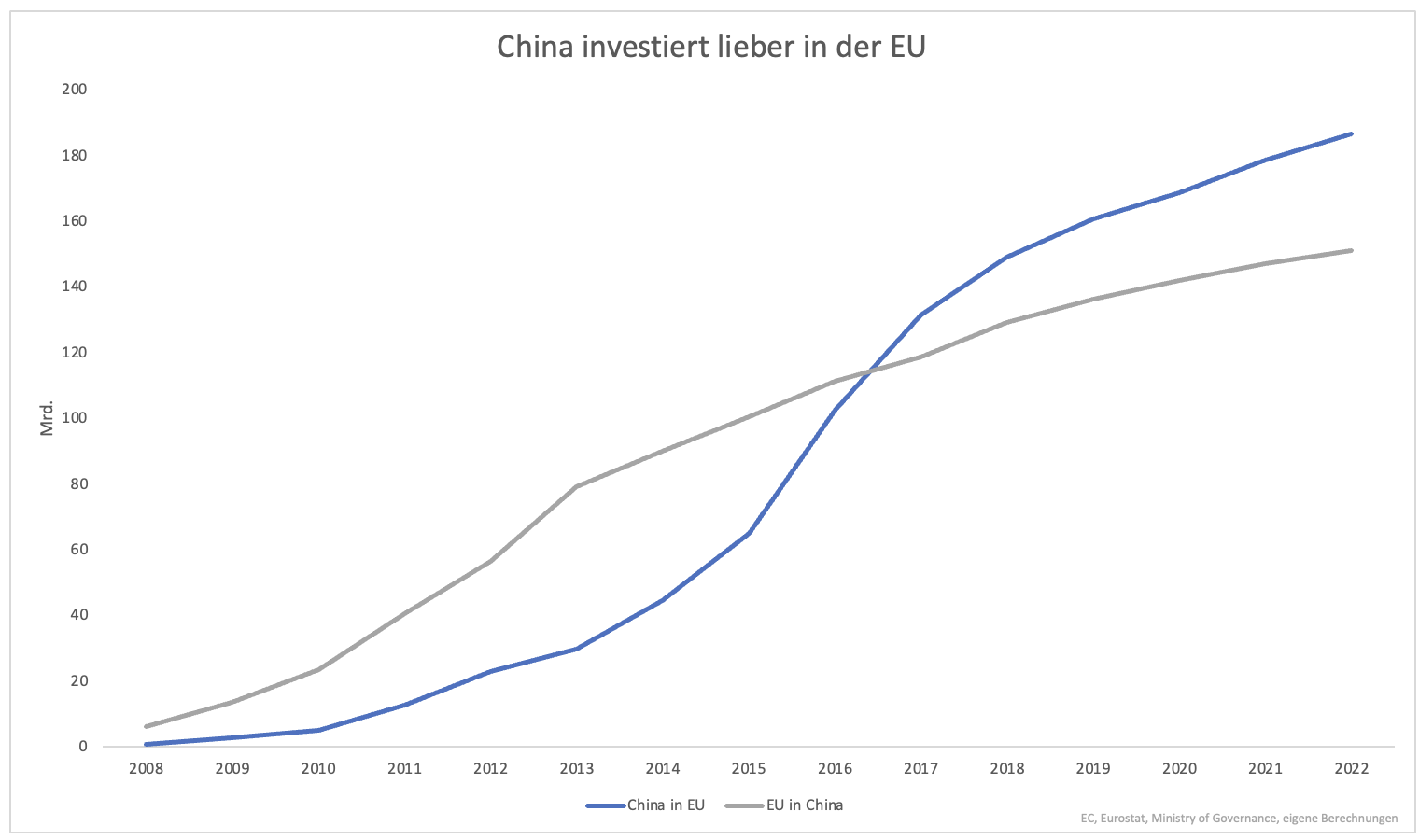

The flow of investment between the two countries accounts for only a small proportion of total investment (Figure 4). EU companies have invested more in China than US companies. China has also preferred to invest in the EU over the US for years, albeit at a slower pace here as well (Figure 5).

The US is ahead of the EU in reducing trade dependency. This is even truer with direct investment. The work of removing the barriers has already started here. China participates enthusiastically. The U.S. and China have little to lose by conflict because they are so intransigent. The process can be speeded up. Because the EU will probably eventually side with the US, greater dependency is important. If the EU and China were more closely intertwined, the US would be less vulnerable than the EU in the event of a sudden disruption.

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

Finnair announces more flights to US in 2025

Can sports stars make a difference? – DW – October 22, 2024

Fewer and fewer people trust the results – DW – October 19, 2024