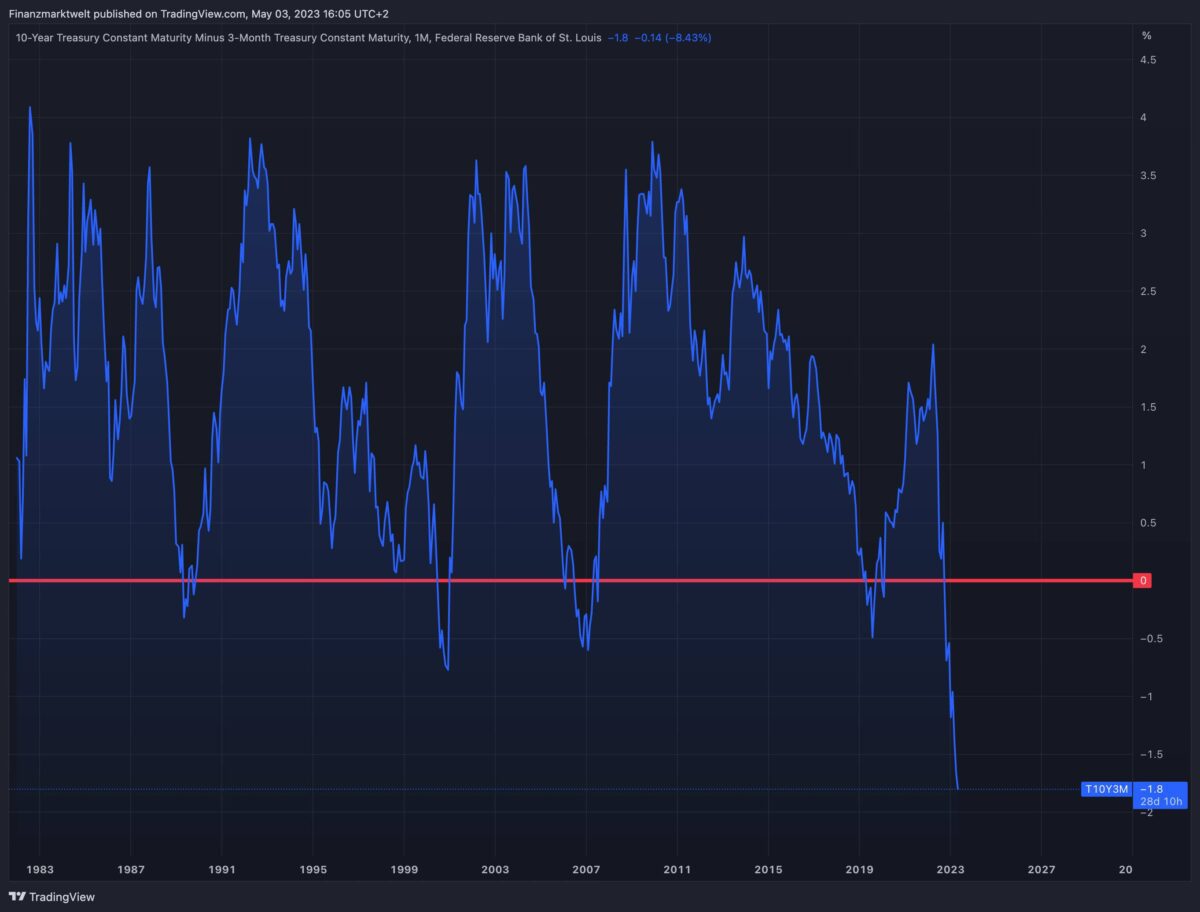

Although not a 100% guarantee, an inverted yield curve (or inverted yield curve) is a good signal that a recession is imminent in the US. This means that short-term government bonds in the US have higher yields than long-term government bonds. Because normally, longer term bonds should yield higher returns.

Currently we see: 3-month US Treasury yields 5.23%, 10-year US Treasuries 3.38%. The difference (inverted yield curve) was 1.85 percentage points, a record! In the chart below, we see this yield curve since the 1980s. The inflection of the yield curve has never been so deep! We explain in more detail why this reversal is so important to recognize a recession when you click here.

Below we see the inverse yield curve between the 2- and 10-year US government bonds. A reversal of the current 0.57 percentage point, this is not a record. At the beginning of March 2023 (the beginning of the US banking crisis), the limit was already 1.00 percentage points.

Charts: Trade show

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

In “Cash for Rares” he reveals his plans

The DFB women face a tough fight against heavy favorites USA

Who is showing/broadcasting France vs USA (Olympia) live today on live stream and TV?