December 16, 2023, 4266 characters

Visa (NYSE: V), a global payments leader, today announced the launch of Visa Provisioning Intelligence (VPI), an AI-powered product designed to combat token fraud at the source. VPI is available as a value-added service to clients and uses machine learning to assess the likelihood of fraud in token deployment requests. This allows financial institutions to specifically prevent fraud and provide smoother and more secure transactions for Visa cardholders.

Tokenization is a powerful anti-fraud technology that helps protect consumers’ account data from malicious actors by replacing account numbers with a unique code. However, the codes can be illicitly distributed to malicious actors. Visa found that losses from token deployment fraud reached an estimated US$450 million worldwide in 2022 alone.1.

“Although tokenization is one of the most secure transaction methods, we are seeing fraudsters use social engineering and other fraudulent methods to illegally provide tokens,” said James Mervyn, senior vice president and global head of risk and identity solutions at Visa. “With VPI, we leverage Visa’s extensive network and data expertise to help customers identify and prevent service fraud before it happens.”

VPI is a real-time fraud risk score between 1 (lowest probability of fraud) and 99 (highest probability of fraud)2, which is provided to issuers for each token deployment request. VPI uses a sector-level supervised machine learning model to detect patterns in past hardware token requests, e-commerce, and card tokens on file to predict the likelihood of token deployment fraud. The CPI score is intended to provide financial institutions with the following benefits:

- Improve fraud prediction by enabling issuers to detect provisioning fraud and deny a token provisioning request before fraud occurs.

- Strict separation of fraudulent and non-fraudulent activities, reducing the number of rejections.

- More legitimate replenishment requests, higher payment volumes, and continued trust in the card payment network.

In an era where most of our financial lives are digital, Visa remains focused on enhancing the security of its network and providing its customers with innovative technologies to ensure customer data is protected wherever transactions occur. VPI is now available to customers around the world as part of Visa’s suite of value-added services. If you would like to learn more about Visa’s risk and identity solutions, visit our website Smart security.

About Visa Company

Visa (NYSE: V) is a global leader in digital payments, enabling transactions between consumers, merchants, financial institutions and governments in more than 200 countries and territories. Our goal is to connect the world through the most innovative, convenient, reliable and secure payment network so people, businesses and economies can thrive. We believe that inclusive economies support everyone, everywhere, and we see access to services as the foundation for the future of money. Learn more at Visa.com.

___________________

1 Visa risk management information systems

2 Clients may receive a zero, indicating that the token deployment request has not been evaluated

The source language in which the original text is published is the official and authorized version. Translations will be included for better understanding. Only the language version that was originally published is legally valid. Therefore, compare the translations with the original language version of the publication.

View the original on Businesswire.com: https://www.businesswire.com/news/home/20231213222370/de/

BSN Podcast

Christian Drastl: Vienna Stock Exchange Chat

Austrian Stocks in English: Week 50 was good for the value of the ATX TRs and ideal when it comes to trading volume

Stocks on the radar:California real estate, We were tempted, Re Magnecita, Vienna Airport, Eurotelesites AG, Austriacard Holdings AG, Mayer Mellenhof, Reserve Bank of India, Mortgage, rosegx, compound, AVN, Strabag, semperite, SBO, Uniqa, Rath AG, UBM, Wolftank Adisa, Warempex, Mobility Pierre, Adecco Bank, Amaj, Capsh Traffic com, Austrian Post, Telekom Austria, Fig, Mercedes Benz group, Sartorius, So they asked him, Evotec.

Random partners

RWTA AG

RWT Hornegger & Thor GmbH was founded in 1999 by Managing Directors Hannes Hornegger and Reinhard Thor. Since then, the company has grown continuously and currently has approximately 30 employees. The company is active in the fields of tool making, die making, prototype building and assembly production, and also produces modern engine components and precision parts.

>> Visit 68 other partners boerse-social.com/partner

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

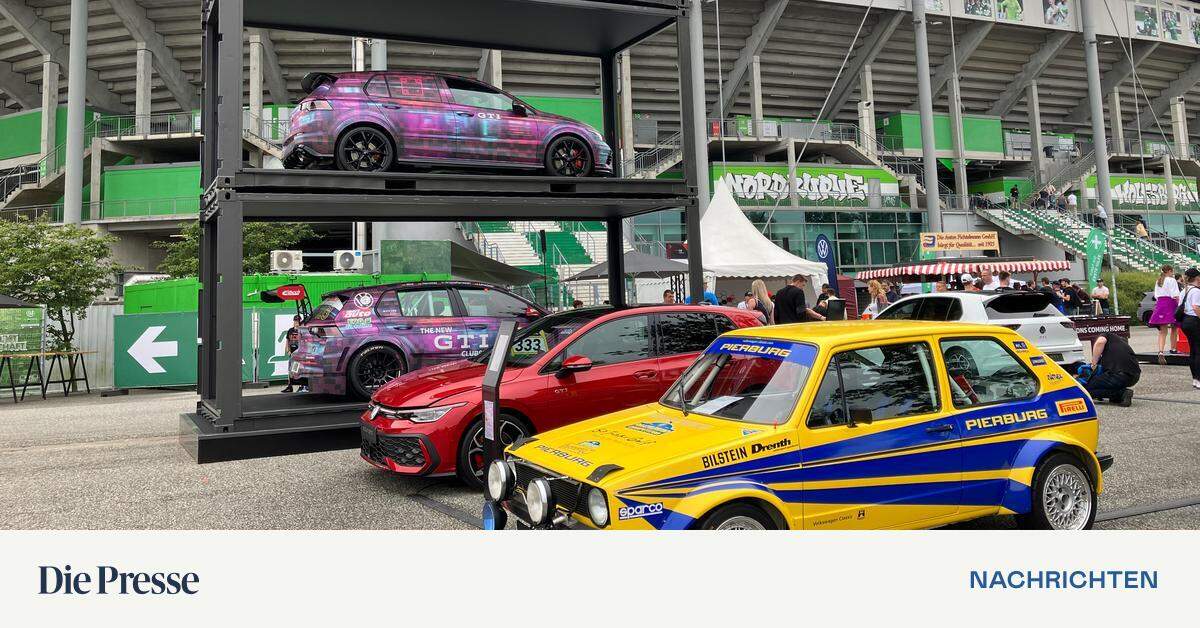

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.