When looking for new capital, Cigna faces three problems:

1. In contrast to the period before the interest rate shift, Signa cannot promise growth at the moment, but is struggling to keep losses to an acceptable extent. This generally makes Signa unattractive to potential donors.

2. As early as the summer of 2023, the European Central Bank called for it According to media reports Banks are examining their loans to Signa Group for value. A warning shot that would make banks particularly wary about giving new loans to Signa.

3. The Signa Group is a difficult-to-understand network made up of hundreds of overlapping subsidiaries. The business relationships between these companies are difficult to understand from the outside. This lack of transparency makes finding investors more difficult.

However, if Signa cannot find enough new investors or lenders to replenish expiring lines of credit and defray the ongoing costs of construction projects, the only option left is to obtain new capital through stock and real estate sales (Some of this is already happening) – or all that’s left is to go to bankruptcy court.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

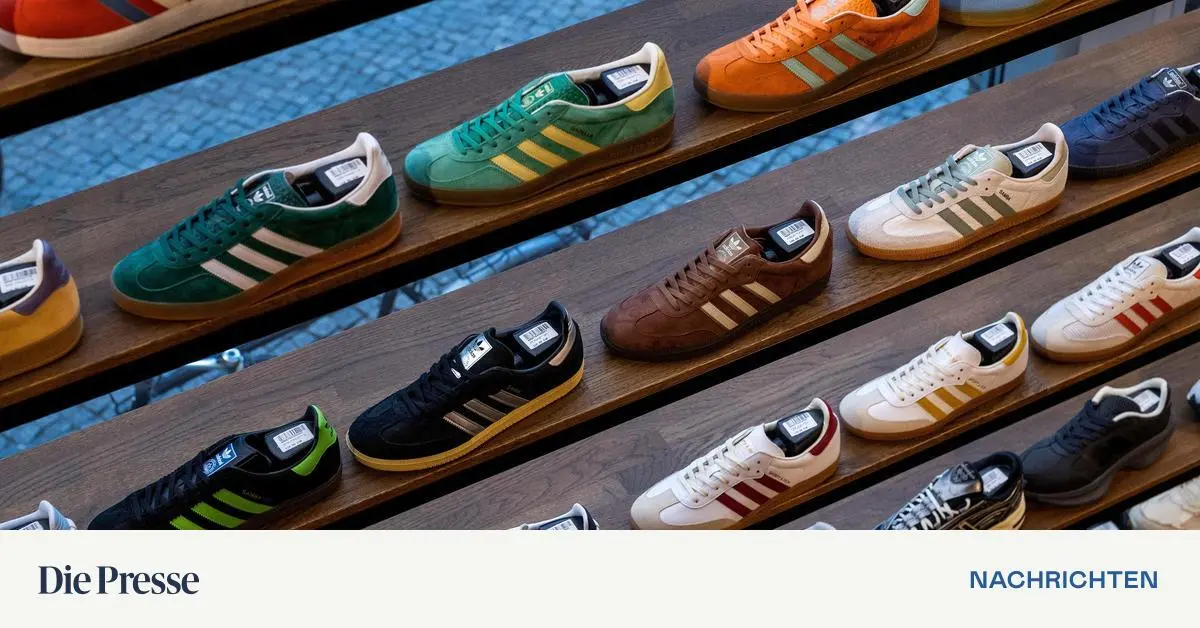

Adidas suffers a setback in the US court in the nudity dispute

Heavy costs for Magna due to the end of Fisker in Graz

Green bonds for private investors | Salto