In Europe alone, the number of pro-climate votes, asking shareholders to greenlight corporate climate plans, has more than tripled in the two previous periods. This trend is likely to continue as more companies look to adopt plans to combat climate change. But is this likely just a mandatory assignment or even greenwashing? How should investors judge such offers? We have dealt with our internal affairs Active property expert Julia Wittenberg met for an interview to gain insight into their point of view.

What exactly are these Say-on-Climate proposals and why is there such a spread of votes right now?

Climate-related proposals have been on the agenda of the Annual General Meetings for a number of years. However, in most cases, these are the suggestions made by the contributors that with CO2Intensive companies should be encouraged to better manage their emissions, for example by setting targets to reduce greenhouse gas emissions. The development over the past two years differs in that the increase in bids comes from management seeking shareholder support on the company’s climate strategy – the so-called “voices on climate”.

Mandatory disclosure of climate-related financial information has increased in many markets, often with the introduction of the reporting framework recommended by the Task Force on Climate Financial Disclosures (TCFD) – as is now the case in Switzerland. Investor groups, such as the Net Zero Asset Management (NZAM) initiative, of which J. Safra Sarasin Bank is a member, have also helped push climate issues up the agenda for ESG investors. Companies have responded to investor concerns, as well as increasing demands for transparency from other stakeholders, by voluntarily putting their climate policies to a non-binding vote at their annual general meetings.

Proxy advisors, who provide voting guidance to many institutional investors, can have a significant impact on the outcome of these votes. How do voting rights advisors comment on Say-on-Climate?

The agents’ most influential advisors1 The founders of Shareholder Services Limited (ISS) and Glass Lewis have very different views on these proposals. ISS supported nearly 95% of Say-on-Climate decisions introduced in European markets in 2022. In contrast, Glass Lewis advised customers to vote against or abstain on more than 40% of offers. One of the main reasons these two advisors have different voting recommendations is the belief that management should take ultimate responsibility for the company’s climate strategy and not delegate it to shareholders.

Both proxy advisors tend to take a more critical stance on opinion voting on climate, partly reflecting the complexity of analyzing such proposals, whether they be transparent CO2 disclosures2Missions, long-term commitments, or credible goals. Say-on-Climate is still in its infancy and opinions are mixed. While proponents are convinced that this will reduce carbon dioxide disclosure2Emissions have been improved and shareholder involvement encouraged. Others question this development. Vanguard, for example, has warned about the importance of voting with “climate opinion”, raising concerns about “potential disruptions and unintended consequences in terms of governance and accountability”.2

To date, there have already been many different opinions on the subject of Say-on-Climate. What are some positive aspects of these proposals?

The Say-on-Climate proposal raises awareness of climate issues and allows shareholders to voice their opinions on the company’s proposed climate transformation plan. From a company perspective, this is important because it allows the company to secure shareholder support in defining and implementing its climate strategy, even if the vote is not legally binding. In Europe, we also bring environmental concerns to the Annual General Meetings, which are rated positively.

What are some concerns? What about concerns about greenwashing?

The votes are purely advisory in nature, and the proposals sometimes lack clarity and ambition. For example, companies tend to be vague about implementing their long-term strategy. So we must undoubtedly keep an eye out for the possibility of greenwashing. Also, there is currently no legal basis for retaliation if a company is unable to secure majority support for the Say-on-Climate proposal. To date, the companies have not resubmitted the Say-on-Climate proposals to shareholders for a vote in subsequent years. These are always one-time events. In addition, there is a potential risk that the company may shift responsibility for its climate transition strategy to shareholders.

How can some of these concerns be addressed?

Raising awareness of climate issues, developing a strategy, giving shareholders a voice on the issue, and generally increasing transparency are all positive developments in my view because they increase accountability to shareholders. But the devil is often in the details. While the climate strategy is important, its successful implementation over time is critical. To this end, we like to see milestones in action, short and medium term goals and objectives, etc. In our view, simply setting a long-term goal to reduce carbon dioxide is not enough2– For the formation of emissions.

However, we are still at the beginning of this development. Thus, penalizing companies that benefit from the Say-on-Climate movement early on would be counterproductive. However, staying engaged and monitoring developments over time would be a more viable way to ensure more positive outcomes for all.

What is J. Safra Sarasin Sustainable Asset Management’s position on “speaking on the climate”?

At J. Safra Sarasin Sustainable Asset Management, we evaluate Say-on-Climate proposals on a case-by-case basis, and our first step is always to encourage management teams to be transparent about their climate strategies through multiple channels. In relation to the highest emitting companies in our investment world, we are guided by our voting rights policy on climate issues and engage in dialogue with companies on climate issues either ourselves or jointly, for example as part of the annual Carbon Disclosure Project (CDP) disclosure campaign.

1 Proxy advisors provide institutional and other investors with analysis and voting recommendations for shareholder meetings of publicly traded companies.

2 vanguard

Other sources:

ISS Governance Insights, 2022 European Vote Results Report

Say about the weather in the 2022 Proxy season, Georgeson

Past performance results do not allow any conclusions to be drawn about the future development of an investment fund or security. The value and income from investing in funds or securities may go up or down. Investors may only pay less than the capital invested. Currency fluctuations may affect investment. Observe the Advertising and Offering Regulations contained in InvFG 2011 §128 ff. The information on www.e-fundresearch.com does not constitute any recommendations to buy, sell or hold securities, funds or other assets. The information on the e-fundresearch.com AG website has been prepared with care. However, there may be unintentionally false representations. Therefore, no responsibility or guarantee can be assumed for the objectivity, correctness and completeness of the information provided. The same applies to all other websites referred to via hyperlinks. e-fundresearch.com AG disclaims any liability for direct, identifiable or other damages arising in connection with the information provided or other available information. NewsCenter is a special paid form of advertising from e-fundresearch.com AG for asset management companies. Copyright and sole responsibility for the content rests with the asset management company as a user of a particular form of NewsCenter advertising. All News Center notifications are press releases or marketing communications.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

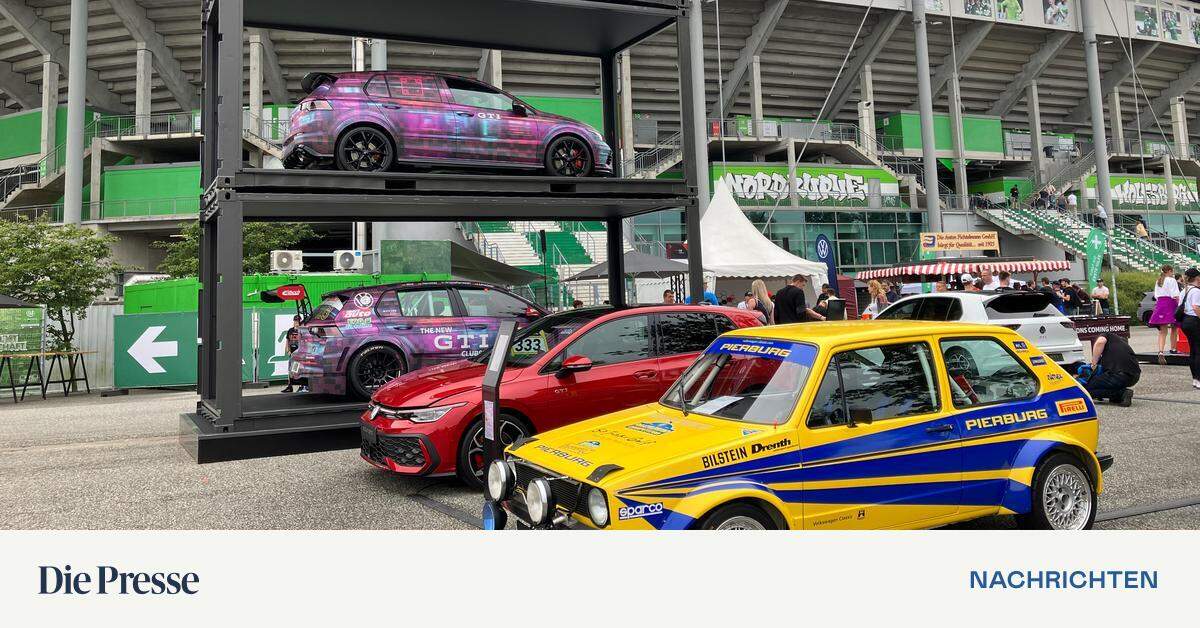

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.