October 23, 2023 – Financial assets of private households in Austria increased slightly to €838 billion in the first half of 2023, but, adjusted for inflation, lost 7% of their value. The National Bank announced this on Friday. Increased consumption also limited the possibility of financial investments. Recently securities have been purchased privately, and demand deposits have been reduced in favor of restricted deposits. Retirement savings products have also become less important in recent years.

- Photo: Sarah Korvis on Unsplash

“Successful savings and investments have rarely been as challenging for private households as they are in the current economic environment characterized by financial stress and geopolitical uncertainty.”

This was stated by Gottfried Haber, Deputy Governor, on Thursday Austrian National Bank (OINB). OeNB published figures on the development of Austrians’ financial assets on Friday.

According to the OeNB, negative real yields, rising energy and food prices as well as the need for consumption that continues to have the impact of the pandemic have “significantly reduced” opportunities for financial investments.

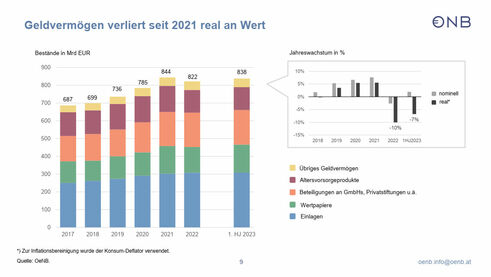

Financial assets increased in nominal value and decreased in real value

In nominal terms, Austrian household financial assets fell to EUR 822 billion in 2022 (2021: EUR 844 billion) and rose again slightly in the first half of 2023 to EUR 838 billion.

In real terms, that is, after adjusting for inflation, there was minus 10 percent in 2022 and minus 7 percent in the first half of 2023.

- Development of financial assets since 2017 (Chart: OeNB). Click on the drawing to enlarge.

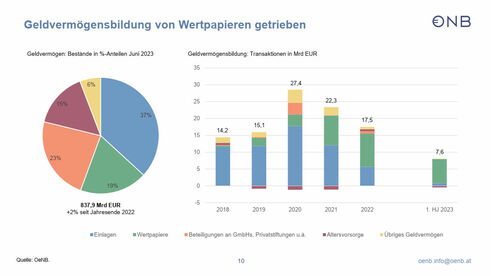

Positive stock trend

At €17.5 billion, households invested about a fifth less in financial investments than in 2021 (€22.3 billion), compared to 2020 (€27.4 billion), that is, about a third less.

According to the OeNB, the trend towards increasing purchases of securities, which was noticeable about two years ago, continued in 2022 and the first half of 2023 with investments amounting to EUR 9.8 billion (+12 percent compared to 2021) and EUR 7.2 billion, respectively. .

“Interest-bearing securities were in particular demand, with a total of €6.25 billion purchased in the last four quarters (up to and including 2Q23), with domestic securities – especially bank bonds – dominating,” the National Bank said. .

At the end of June 2023, the volume of securities owned by private households reached 157 billion euros. This means a 19 percent share of total assets.

- Composition of financial assets: components and transactions (chart: OeNB). Click on the drawing to enlarge.

Great transition from journaling to binding

In contrast, deposit growth in 2022 almost halved to EUR 5.7 billion (2021: EUR 12.1 billion).

“Private households responded to the change in interest rates by a significant shift away from overnight deposits towards tied-up forms of investment,” Haber explained.

The latter was built up to €10.4 billion in the first half of 2023, while overnight deposits were reduced by €9.7 billion.

Deposits still make up the largest share of the portfolio at 37% – €309 billion in the second quarter – but have lost their importance in the composition of financial assets in recent years, OeNB notes.

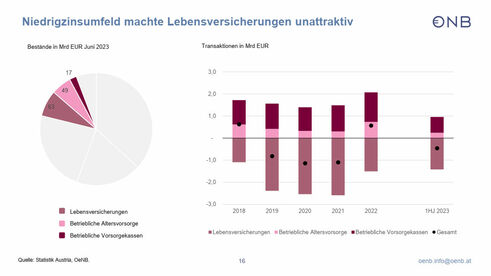

Retirement savings products are becoming less important

Retirement savings products have also become less important in recent years, notes OeNB. “Overall, they were mostly sold out or only built to a small extent.”

In particular, the life insurance commitment has been reduced significantly “in light of the unattractive interest rate environment and guaranteed interest rates that have remained low for an extended period.”

Commitment to corporate pension funds and corporate pension schemes – i.e. superannuation funds, corporate group insurance and direct claims against employers – was positive.

- Life insurance and retirement savings (chart: OeNB). Click on the drawing to enlarge.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Warning at Pepco: a large-scale recall campaign due to dangerous products – Vorarlberg –

Leadership questionnaire and Tuesday meeting

Mini Countryman: Outdoes itself