The Grand City Properties group of residential properties continues to be driven by strong demand for apartments.

However, rental income declined slightly in the first half of the year due to property sales. This also had an effect on the results. MDAX confirmed its full-year targets on Tuesday in Luxembourg.

In the first half of the year, its operating result (FFO 1) rose year-on-year by 3% to €94.2 million, as reported by Grand City Properties. In contrast, net rental income decreased by 2% to €183.1 million due to the sale of properties. Adjusting for this effect, the homeopathic rental income increased by 2%. Most of the growth comes from rent increases, and the rest from reducing vacancies.

The average contractual rent per square meter rose year on year from seven to eight euros at the end of June. Above all, rising rents in London contributed to this. On the other hand, rents stagnate in Berlin. A few months ago, the Federal Constitutional Court declared Berlin’s rent coverage law, which had been in effect for more than a year, null and void. Among other things, landlords had to significantly reduce rents during this time. Now you can increase it to the original level.

In the first six months, Grand City Properties sold properties in Halle, Gera, Plauen and Görlitz in the amount of about 300 million euros. In return, the company acquired real estate in the amount of about 300 million euros, including in the British capital London and Berlin. She said that some properties will remain in the pre-letting stage.

The bottom line was that there was little left in the first half of the year, due, among other things, to bond repayments and bank debt, but also to lower valuation gains on real estate: the surplus attributable to shareholders shrank 41% to €120.7 million.

For the whole of 2021, the company is still aiming for an operating result (FFO 1) of €183 to €192 million after €182 million in the previous year. On a comparison basis, rents are expected to rise by two to three percent. For 2021, the company plans to pay a dividend of 81 to 85 cents per share.

The company is making good progress with a share buyback program that will run through the end of the year. It was said that shares of about 160 million euros have already been repurchased in the first half of the year. In general, the company wants to acquire its own shares amounting to 270 million euros.

Grand City Properties are especially active in densely populated areas of Germany, for example in Berlin, North Rhine-Westphalia, in the district of Halle-Leipzig-Dresden and in the region of Rhine-Main. In addition, Grand City Properties are also represented in cities such as London and Munich. The main shareholder of the company, which is headquartered in Luxembourg, is the commercial real estate group Aroundtown.

Grand City shares post profits

The generally volatile papers of Grand City Properties initially filed amicably on Monday in XETRA trading according to the numbers. At its peak, at €23.94, it came a little closer to its temporary high of €24.06 since mid-June. But during the day they changed the sign and sometimes went down 0.51 per cent to €23.52.

Luxembourg/Frankfurt (dpa-AFX)

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

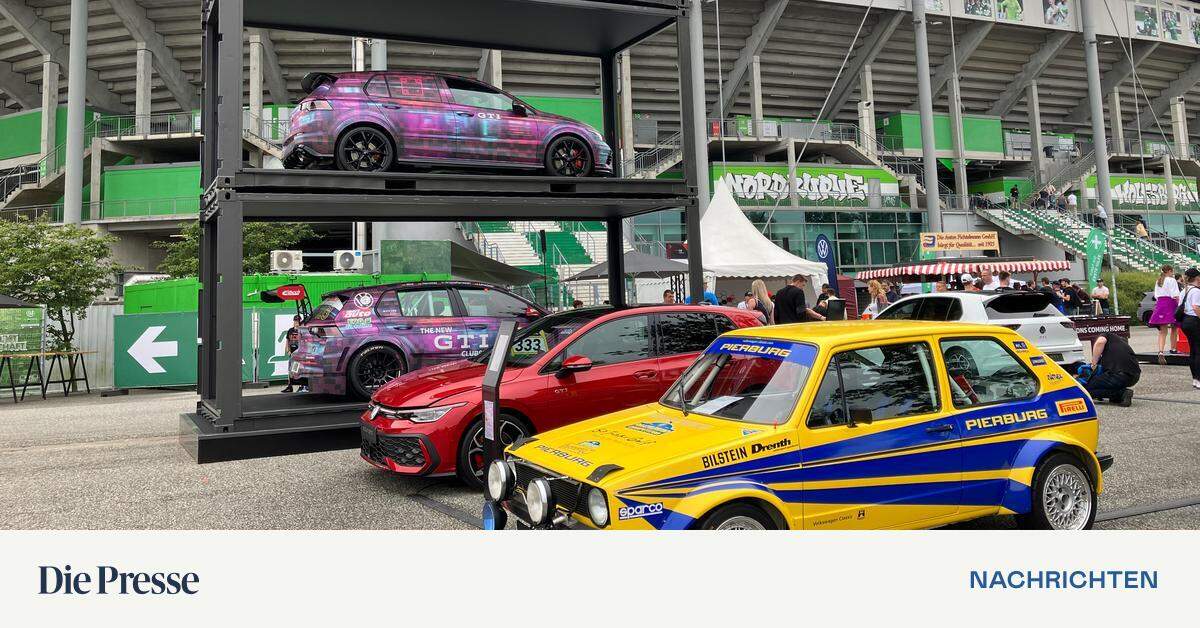

Wolfsburg instead of Wörthersee: The first GTI meeting starts at Volkswagen headquarters

Pecco Bagnaia (Ducati): Testing on the new Panigale/MotoGP

From autumn onwards, U2 will be playing again at Karlsplatz.